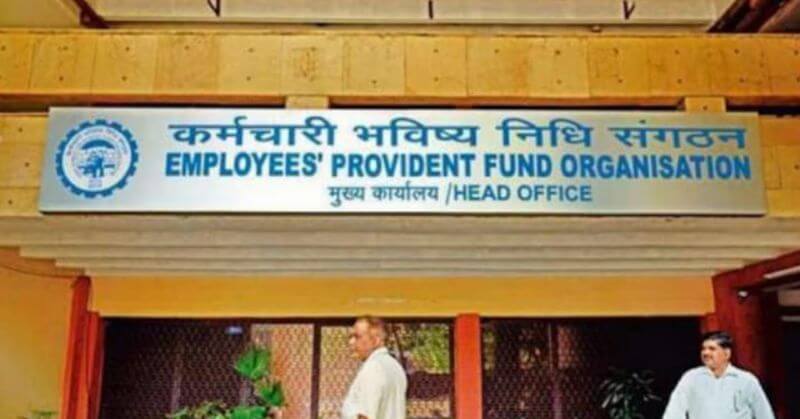

The current changes made by the Employees’ Provident Fund Organization (EPFO) are a step towards convenience and efficiency. The changes were applied from April 1, 2024, with the purpose of changing the conventional way of EPFO functioning. Countless EPFO members from India will be part of simplified procedures, enhancing their experiences when it comes to government services. This leads to a new age of life simplicity and easy funds transfer.

New EPFO Rule

EPFO implements automatic fund transfers for job changes, effective April 1, 2024. You can transfer funds retained in provident funds to your new employer account without a hitch. There is no need for manual transfer requests because automatic transfer requests eliminate tedious previous manual processes. This reform will help its members avoid unnecessary complexities and make the transition easy, thus improving their experience. With Universal Account Numbers (UANs), the process becomes even more seamless.

Membership Statistics

EPFO experienced significant growth, adding 15.62 million members in December 2023. During the same period, 8.41 million new members were enrolled, marking a substantial increase. Approximately 12.02 lakh members exited and rejoined EPFO, signifying dynamic workforce movements. These figures highlight the growing trust and participation in EPF schemes. EPFO’s outreach efforts help broaden its membership.

EPFO Announces Interest Rate, Offering Competitive Returns

EPFO announces a high three-year interest rate of 8.25% on EPF deposits for 2023-24. This rate hike reflects EPFO’s commitment to maximizing member benefits. In March 2023, the previous fiscal year’s interest rate was slightly increased to 8.15%. These competitive rates encourage long-term savings and budgeting. EPFO’s proactive approach to interest rates ensures member satisfaction and financial stability.

The justification of new EPF norms, which are accompanied by members’ increases and competitive dividends, makes it clear that the EPFO is doing its best to add financial security for the employees. The above reforms rectify the processes and enhance the user experience by personalizing and stimulating participation in EPF programs.

Follow Us: Facebook | Instagram | X |

Youtube | Pinterest | Google News |

Entertales is on YouTube; click here to subscribe for the latest videos and updates.