Dr. B.R Ambedkar in his thesis, “the Problem of Indian Rupee” had suggested that the notes should be changed/ demonetized after every ten years to curb the menace of corruption and black money.

Let us see the previous and present demonetisation and decide if the present one will be a success.

The largest note ever printed by the Reserve Bank of India was Rs.10000 which was introduced in 1938 by the British India government and subsequently again by Independent India in 1954. The notes introduced were Rs.500, Rs.1000, Rs.5000 and Rs.10000.

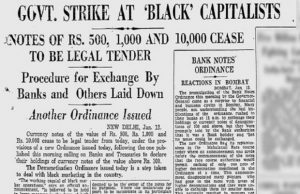

These notes were withdrawn in 1946 by the RBI under the British Indian Government to curb the black money menace in India. These notes were exchanged for Rs.100 or lower denomination.

Date: 12th January, 1946 probably declared in the morning working hours

Motivation: Steps taken by the Government of France, Belgium and United Kingdom.

Announced By: – RBI headquarters, Mint Road, Mumbai, India

Result: – The exchange of Rs.143 crore was replaced by new notes of lower denomination of Rs.135 crore, making only 9 crore rupees demonetized, partially successful because it mostly became a conversion scheme rather a demonetization scheme.

The notes were re-introduced in 1954 by the RBI, which was subsequently demonetized in 1978 by the Morarji Desai-led Janta Parivar government, just after the downfall of the Indira Gandhi government in 1977 due to Emergency crisis the country faced.

Date: – 16th January, 1978 at 9AM on the All India Radio

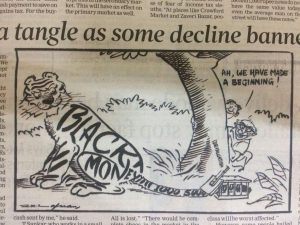

Motivation: – To curb the black money menace and make a comeback from the Emergency period problems by starting afresh for the betterment of the Indian economy.

Announced By: – R Janaki Raman, a senior official from chief accountant’s office at RBI Headquarters in Mumbai.

Result: – It was also more like a culmination process rather a conversion process in 1946. This was because there were rumours about the demonetization before it was announced in 1978, making the black money hoarders alert to store money in lower denominations. It was a failure in terms raked in 1946.

We learn from our mistakes: The demonetization of 2016.

As stated earlier the reasons for demonetization, the government seems to have come prepared for the same.

In 2014, Prime Minister Narendra Modi announced zero-balance account for all the citizens of India under the Pradhan Mantri Jan Dhan Yojana along with RuPay Debit Cards, OD facility, etc…. This was done to bring about financial inclusion in the country.

The government also announced Insurance schemes and Pension schemes from these accounts for its lifetime.

Large number of citizens stood in queues to open new bank accounts with a record of 18 lakh accounts in the first week of the launch of the scheme. Rs.50 Billion was received as deposits from these accounts, an added benefit to the government exchequer.

The government introduced Income Declaration Scheme in 2016 in which the black money could be made white by paying 45% tax on the total amount. The government had kept the deadline of September 30, 2016 and promised to keep the data confidential. The scheme attracted $10 Billion swelling the tax coffers by Rs.30000 crore.

Some months back, the government had made it mandatory for all gold buyers worth above Rs.2 lakh to furnish PAN account details. Gold market went on a strike for the same, but the government didn’t bulge from its stand.

In the meanwhile, GST Bill being passed by the Upper House with a 100% majority proved to be a bright spot on this drive. With GST rates decided 5% to 28% in four slabs, foreign investors have got a good reason to invest in India, which has a good tax structure and less black money.

Come November 8, 2016, PM Narendra Modi announced the demonetization of India’s two largest denominations (Rs.500 and Rs.1000) with effect from midnight.

Salient features of the activity

- Except for Fin Min and top officials of the RBI, no one had the news about the activity which was on cards since 6 months.

- The Cabinet was briefed early on Tuesday and were not allowed to move out of the premises till the PM finishes his address.

- It came as a shocker, but the government seemed well prepared to handle the situation. Mr. PM has left no stone unturned for any hue and cry among the public (let alone the politicians). Mr. PM had got most of the unbanked sector into the banking ecosystem by the Jan Dhan Yojana with Rupay Cards. He then gave an opportunity without extension (through the Income Declaration Scheme) to declare the black money and strictly warned of action to be taken by the government against hoarders.

- The Indian Media is the freest media in the world. Media starts protesting for even a small issue. NDTV India received a ban for 24-hours of the Pathankot Attack coverage (later upheld by the MIB till December 5, 2016) on 9th November 2016. All newspapers, journals, TV reporters spoke about this issue as a serious matter diverting the attention of the media from the demonetization.

- The government announced the decision after Diwali, making fewer problems for the general public.

- The Best part: – The announcement was done by Mr. PM at 8 pm IST rather by the RBI in the morning. Most of the businesses were shut for the day and people were wrapping up from their day’s work. Banks remained closed for the next day paralyzing the country. Black money hoarders couldn’t find a way out to funnel the black money, making it a fool proof plan to nab all the hoarders under the tax radar.

Considering all these aspects we can anticipate further actions and enactment of stricter laws by the Modi Government for tackling the problem of corruption and black money. Without actions against the gold import/ export, benami properties and tax evasions in real estate This decision can become ineffective. The citizens of the country are hopeful that further stringent actions will be taken by the Government against the tax evaders and the benami property holders. These steps are necessary for the demonetization policy to succeed as they will act in addition to the current decision of the Government.

We are eager to hear from you about your view points. Please do share your views.