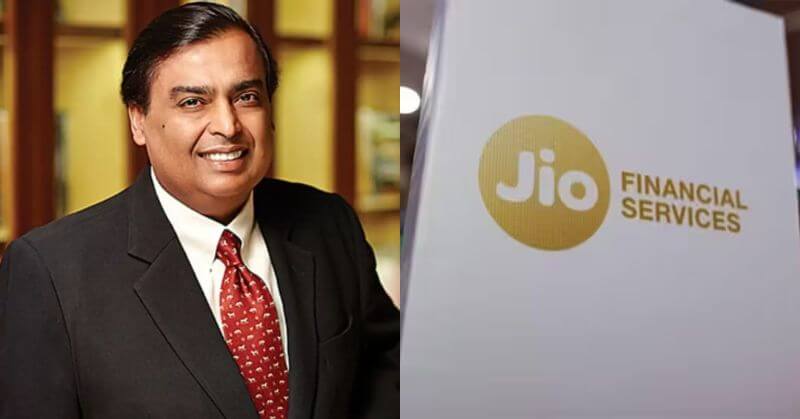

Mukesh Ambani is known for transforming various industries in India. He is now stepping into the banking field. His company, Jio Financial Service, is a part of Reliance Industries. They just introduced a new mobile app. This app aims to bring all the key banking services right to your smartphone. No need to visit bank branches. Everything you need will be available on your phone itself.

Financial Hub In Jio Finance App

The all-new Jio Finance App is a one-stop solution for financial transactions. Starting from UPI payments and bill payments to home loans and insurance, this app has it all. These features on the phone in just a few taps can help to do so. The app has rapidly grown, with over 1 million downloads already. It is just the beginning and an indicator of its future potential to rule millions in finance.

Similarly, Reliance Jio’s entry into the telecom industry has forced established players like Airtel and Vi to regenerate their strategies. The Jio Finance App has the power to disrupt the financial sector. Traditional banks, fintech platforms like Paytm and PhonePe, and even credit card companies are closely monitoring this development. The app’s full-scale launch could make traditional banking methods obsolete.

Future Of Digital Banking In India

According to the current market situation, this app could change banking in a big way. This app has shown remarkable results, which are a huge indication. It will provide a smooth and easy experience for users. It aims to fix any early issues and glitches. Right now, as per verification, Jio payments bank for 3.5% interest on money deposits.

Mukesh Ambani has once again proved that when Reliance enters a market, it doesn’t just compete; it takes over. The Jio Finance App is more than the digital finance space. It has the potential to change how Indians manage their finances. It will push the industry towards a future where mobile banking becomes the norm.

The Jio Financial Services app could revolutionize banking in India. It might affect the old banking methods and change the financial world. Mukesh Ambani’s new app highlights its ability to lead and transform entire industries. The future of banking in India might be right on your smartphones.

Follow Us: Facebook | Instagram | X |

Youtube | Pinterest | Google News |

Entertales is on YouTube; click here to subscribe for the latest videos and updates.