Byju’s which was once valued at $22 billion is now facing legal and financial problems. The tutoring company is backed by the Chan-Zuckerberg Initiative, Sequoia Capital, and Tencent, among others, and even sponsored the Indian Cricket Team until 2023. The edtech company happened to be the star in the field of edtech tutoring companies.

The Edtech Firm’s Struggle

HSBC and BlackRock have written off and slashed their investment and valuations of once a giant edtech that is now down to a worth of zero. The education giant raised $800 million at a $22 billion valuation in 2022.

BlackRock in a first-quarter summary valued its stake in Byju’s at 0, being the first investor to highlight the company’s struggle publicly. As a result, in October it slashed its valuation. The valuation was slashed to less than $1 billion. Various kinds of funds were invested in Think &Learn which is Byju’s parent by BlackRock. These funds seem to have been written off in the latest filings.

In the same way, HBSC slashes its valuation in May to zero. Prosus, the Dutch tech investor’s stake was equal to nothing. This was estimated by HBSC. Prosus invested $500 million in Byju’s and owned nearly 10% of the company.

HBSC’S Note

“We assign zero value to Byju’s stake amid multiple legal cases and funding crunch,” stated the HSBC note.

“Previously, we valued around 10 percent stake in Byju’s by applying an 80 percent discount to the latest publicly disclosed valuation,” the note continued.

“Byju’s is facing multiple headwinds. We and other shareholders are working every day to improve the situation. We are in close discussions with the company every day,” was the statement of a senior Prosus executive in reports late last year.

Legal Proceedings

Bankruptcy proceedings against Byju’s subsidiaries were requested by a group of lenders to the US court. The request was initiated over a $1.2 billion loan. To minimize the cost to the lowest, the company refused to give salaries of new sales hires by 90%, according to the report by local outlet Inc42.

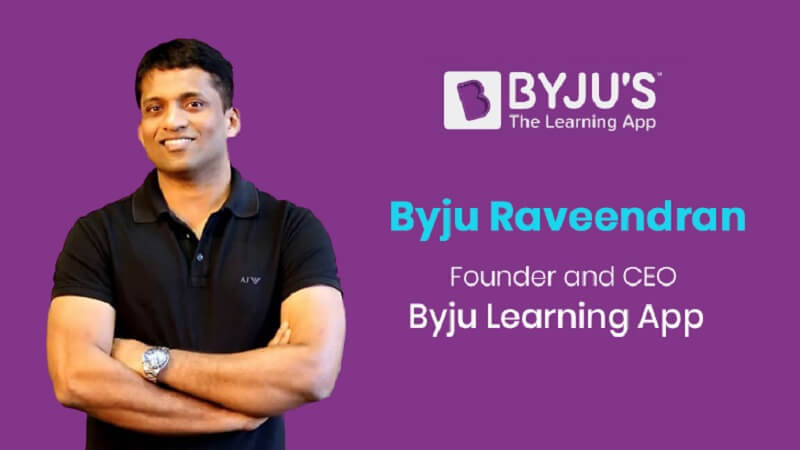

Removal Of CEO

The investors are pursuing the removal of its CEO, Byju Raveendran, including his family members from the board. The Indian CEO missed filing its 2023 financial reports and left in April.

About Byju’s

BYJU’S is a global ed-tech company, that provides exceptionally adaptive, stimulating, and effective learning solutions and education to more than 150 million students around the world.

BYJU’S is backed by blue-chip investors including the Chan Zuckerberg Initiative, Sequoia Capital, Bond Capital, Silver Lake, BlackRock, Sands Capital Management, Alkeon Capital Management, Sofina, Verlinvest, Tencent, Prosus (previously Naspers Ventures), CPPIB, General Atlantic, Tiger Global, Qatar Investment Authority, Owl Ventures, Lightspeed Venture Partners, Times Internet, Aarin Capital and IFC. Since 2017, they have completed more than 15 acquisitions, including companies in the U.S., UK, Austria, India and Singapore.

A 2021 Time 100 Most Influential Company, BYJU’S is headquartered in India, with operations in more than 21 countries globally and learning programs in multiple languages.

Follow Us: Facebook | Instagram | X |

Youtube | Pinterest | Google News |

Entertales is on YouTube; click here to subscribe for the latest videos and updates.