Finally, the year 2020 ended. It was one of the worst years the world has seen due to the coronavirus pandemic. The new year 2021 arrived with new hopes, new beginnings, and new resolutions. There are also expectations for a better year with better changes. There are many changes that are going to happen for us this year. From mutual funds to life insurance, from UPI to cheque payments, there are many changes that are taking place from today. Let us check out the rules that are changing in the new year 2021.

1. Contactless Card Transaction Limit Increased

The limit for contactless card transactions has increased to INR 5000. Now the pin will not be required if you are making payment up to INR 5000. Previously, the limit was INR 2000.

2. Landline To Mobile Phone Calls

Now you have to dial 0 before dialing any mobile number from a landline. Most of the mobile numbers are allotted to the people. This step will give telecom companies to generate around 255 crores of new numbers.

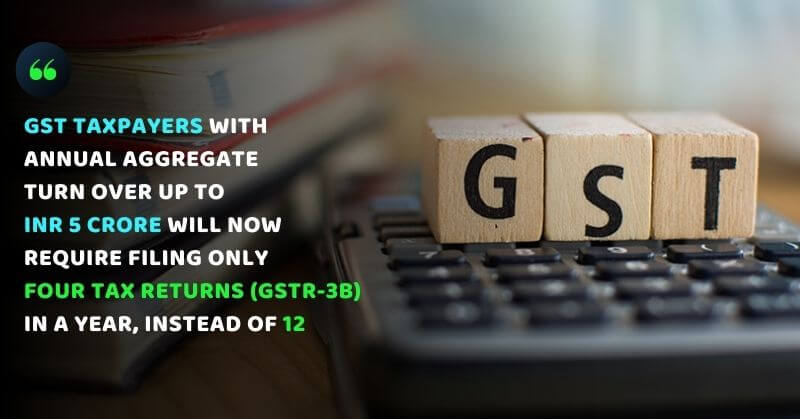

3. Instead Of 12, Four GSTR-3B Returns A Year

It is a big relief for small businesses. GST taxpayers who have an annual aggregate turnover up to INR 5 crore will now require filing only four tax returns (GSTR-3B) in a year. Previously it was to be filled monthly means 12 returns. It provides a major relief to about 9.4 million small businesses.

4. Positive Pay System For Cheques

To enhance the safety of cheque related transactions, the Reserve Bank of India (RBI) has decided to implement a Positive Pay system for transactions above INR 50,000. This rule will come to effect from 1 January 2021, Friday. This concept of Positive Pay involves a process of reconfirming key details of large value cheques. The details are cross-checked with the presented cheque by Cheque Truncation System (CTS). However, the account holder can refuse to take this service.