Yes, Your Phone Is Your Bank Now.

If you have smart phone and Internet data pack, that's it you have bank with you. Just download UPI app and pay money.

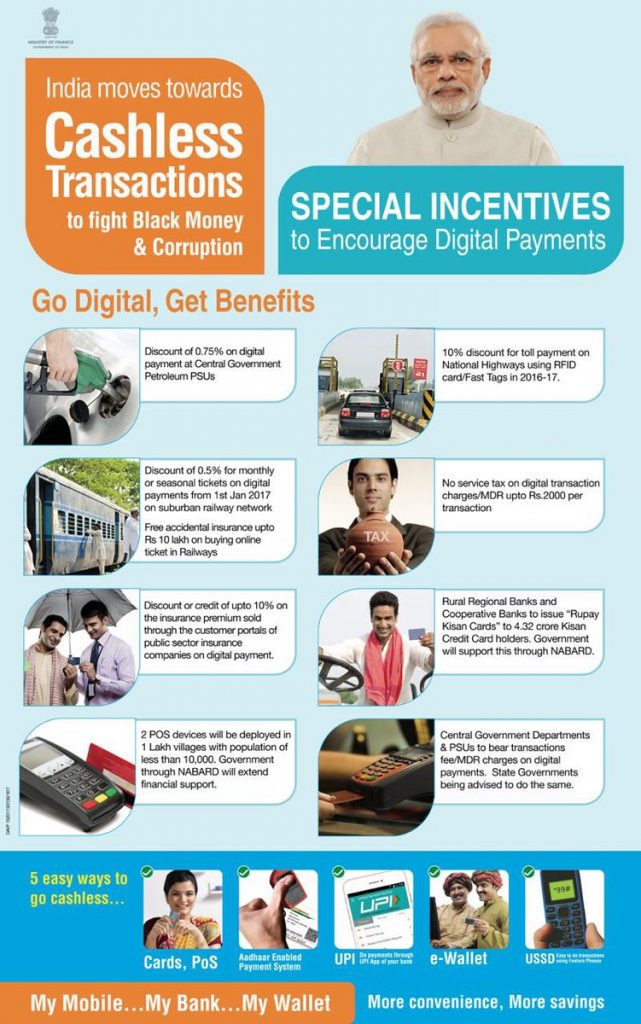

To eradicate corruption, Prime Minister Narendra Modi asks people of India to go for cashless digital payments.

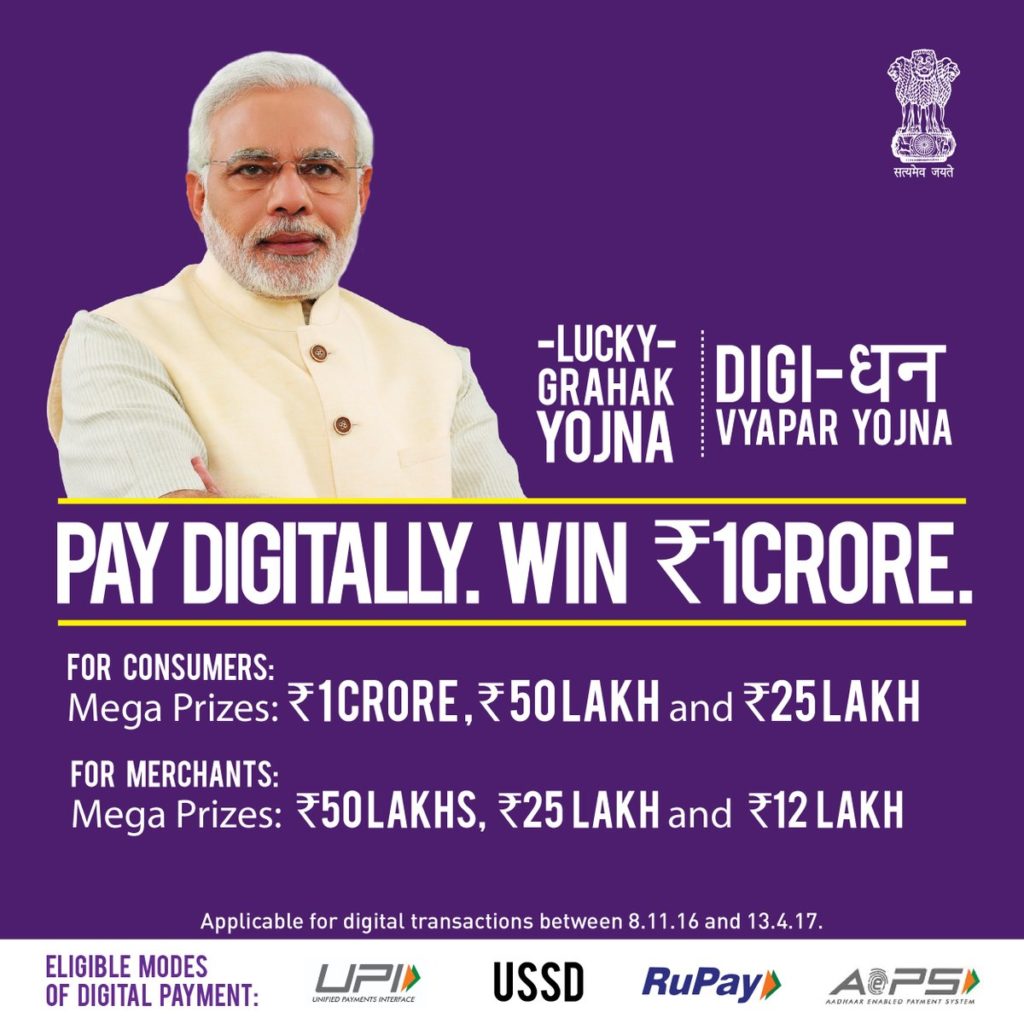

To encourage people to go for cashless digital payments, government is giving rewards in the form of lucky draws.

This Is All You Should Know About UPI

UPI is a payment system that works on mobile platform which facilitates the fund transfer between two bank accounts.

Just like sending a message, you can send money through the UPI app. You are not required to give bank account details for the fund transfer through the UPI payment system.

The funds transfer is done immediately using UPI.

There is no restriction of holiday or working hours. Even the bank strike will not affect the UPI payments.

The amazing benefit is you do not require the bank account number and IFSC code of the recipient.

Just with UPI app, you can transfer funds to any bank account.

You can use the Cash on Delivery without paying cash to the delivery boy. Just approve the bill and the delivery boy would get confirmation.

How UPI Is Better Than IMPS

Well, we all use IMPS for funds transfer but we need to know bank account and IFS code of the recipient. But for UPI, you don’t need any of these details.

You may ask then what about the identification? What if the money goes to the wrong person?

Yes, that is why UPI has come up with a concept of unique ID.

So, every user of the UPI apps must have a unique ID. This unique ID is called as the Virtual Payment Address (VPA).

Now, you may ask how to remember VPA?

It is very easy to remember as it just like an email id. For example vivek@icici, Rajan@SBI, Sohan@axis

In fact, the App provider bank would allot the VPA to each user. You can choose the VPA similar to the mail address.

You can give this VPA to anyone to receive the money. The app would itself keep storing the VPAs of the person to whom you have transferred the money. It is like saving contacts in Gmail. So, from the next time you don’t even require VPA of the recipient.

If you use NEFT for funds transfer, transfer charge is atleast Rs 2.5, whereas for the IMPS fund transfer charges are minimum Rs 5. But for a transaction through the UPI would cost about 50 paisa.

Now, aren’t you thinking where to get official UPI app?

There are several UPI Apps. Each bank has its UPI-based app. In fact, most of the banks have incorporated UPI in their existing mobile application. If you already have an app of a bank, the update would be sufficient.

Otherwise, you can download the UPI enabled app from the google play store. Also, you can check here for UPI enabled banks and download concerned app.

UPI app just acts as the link between you and your account. For this, you have to connect UPI app to your bank account. This is a one-time process. It is done when you download a new UPI app.

While connecting to the bank account, you have to authenticate it through the card details and OTP. Once, your UPI app gets connected to a bank account, you can easily transfer fund to any person.

Step-by-Step Guide To Send Money Through the UPI App

1. Open the UPI app using the passcode.

2. Click on Send money.

3. Choose the bank account from which you want to send money. If you have linked one account, you are not required to choose.

4. Select the receiver. You can choose a receiver using the VPA as well as the bank account number and IFSC code. So, it is better to get the VPA of money recipient.

5. Add the VPA, if it is not already added.

6. Enter the amount and send the money.

7. Before the final confirmation, you have to enter the MPin.

8. The money immediately gets credited to the account of the recipient.

The per transaction limit is Rs 1 lakh.

Still not motivated to use UPI?

Government has come up with lucky draw schemes to encourage UPI digital payments.

The prize money is Rs 1 Crore.

The lucky Grahak Yojana is a big scheme and give you the cash prize. Government is spending Rs 340 Cr for this digital payment lucky draw. The Prize would be given for 100 days

There are daily prizes too where in every person would get Rs 1000 in lucky draw.

In weekly prize, you will get worth Rs 1 lakh, Rs 10,000 and Rs. 5000.

Here Is the Mega Prize

The Mega draw would happen on 14th April, on the day of Ambedkar Jayanti.

3 Mega Prizes would be given

1. The first prize would be of Rs 1 Crore

2. Second prize is Rs 50 lacs and

3. Third prize is Rs 25 lacs

Eligibility For Lucky Grahak Yojana

These prizes would be given to those who pay using the cashless mode/digital payment.

The payment through the Mastercard or visa Debit/credit card is not eligible for the Lucky Grahak Yojana

Then what mode?

If you do payment from any of these following modes, you are eligible to participate in lucky draw and get money.

1. Unified Payment Interface (UPI) – This is mobile app based payment system. Most of the banks has integrated the UPI to their existing mobile apps. SBI Pay, PNB UPI, Axis Pay, PhonePay are the standalone UPI apps.

2. USSD *99# Banking – This system of payment is for those who don’t have a smartphone or internet. To use this type of payment you have to dial *99# from your feature phone.

3. Adhaar Enabled Payment System (AEPS) – This payment system does not require phone, internet or signature. This is done on the micro ATM using your Adhaar and fingerprint.

4. Rupay Card – This may be debit or credit card like Visa and Mastercard. The NPCI has developed this payment gateway. All JanDhan Account holders have got this type of debit card

The payment through the digital wallets e. g. Paytm, Mobikwik, Freecharge, pockets, Buddy would not be eligible for this scheme, unless consumer uses the UPI mode of fund transfer. There are many digital wallets which has integrated the UPI with itself. So, if you use Freecharge and pay through the UPI mode, you would be eligible for the lucky draw.

The digital payments done from 8th November 2016 to 13 April 2017 would be eligible for Lucky draw.

The lucky draw starts from 25 December. Since it goes upto 13 April, there would be more than 100 days.

This scheme is designed to promote digital payments among the lower middle and poor class. Hence, there is upper limit for the transactions. The digital and card payments of more than Rs 3000 would not be eligible for lucky draw. There is a minimum limit of Rs 50.

How To Participate In Lucky Grahak Yojana And Digi Dhan Vyapari Yojna Through UPI

1.Create Your VPA- Virtual Payment Address on any UPI Enabled Bank App.

2.Link with your Bank Account and Set transaction Pin.

3.Ask Your Shop nearby where you ‘Pay by Cash’ to create VPA of their Bank AC too.

4.Ask Shop Owner to generate QR Code of their VPA using link(QR Code Generator) below by entering name & VPA.

5.Generate and Print QR Code As well As VPA to display at Payment Desk of shop.

6.Now every time you buy, Pay on his VPA address OR ‘Scan & Pay’ using your UPI App (Which facilitate scan feature).

7.Now Consumer & Merchant transaction is Eligible for ‘Lucky Grahak Yojna’ as well as ‘Digi Dhan Vyapari Yojna’ for payments between Rs. 50 – 3000 using UPI.

Let's make our India go digital. Aren't you in? Share this information with as many as you can and let's help ourselves.