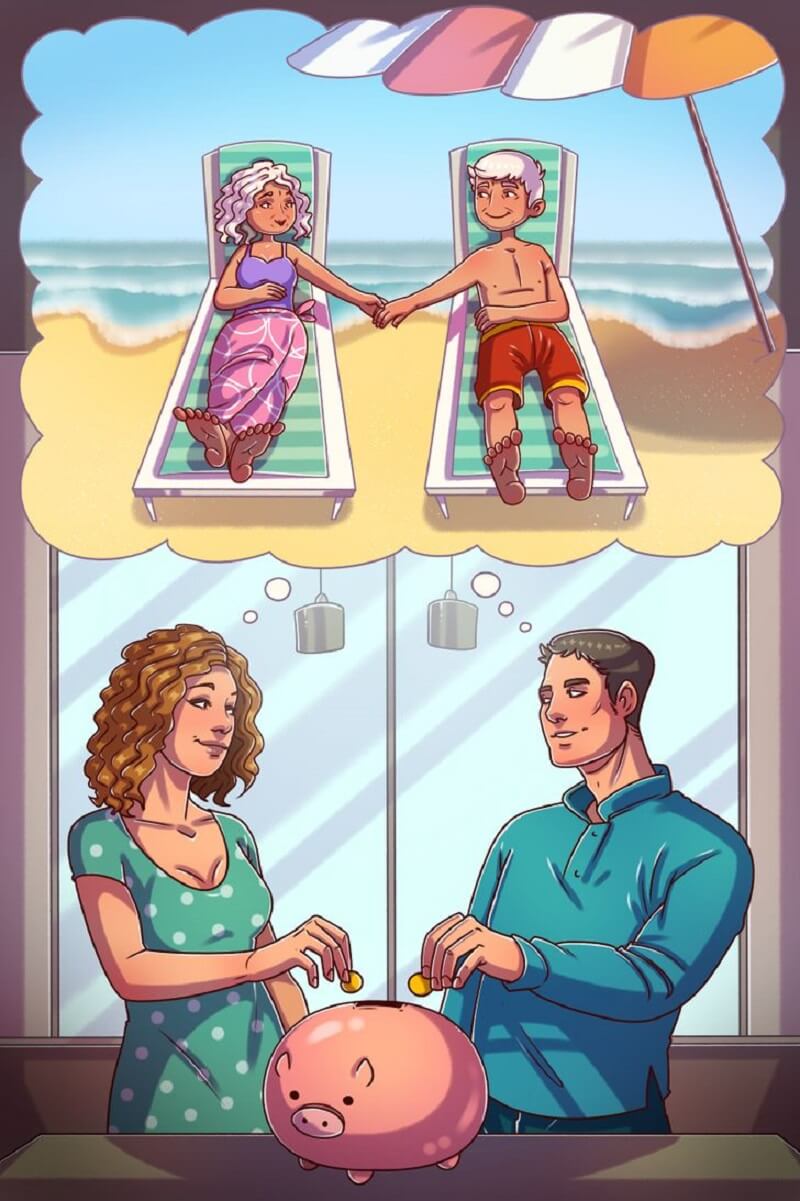

Retirement planning is a critical component of an individual’s financial preparation. It is essential to save enough money for your future to provide for your family’s requirements without relying on others once you retire. It would be tough to maintain your lifestyle after retirement if you do not have any savings or investments.

Even if you save money for the future in a bank account, the inflation rate may lower the amount and the value. As a result, it is critical to identify and choose a suitable retirement plan that will assist you in building your corpus without having to worry about the variable inflation rate.

What Are Retirement Plans

Pension contributions are a tax-efficient method to profit from your company. If you want to sell your firm to finance your retirement, using pension allowances is a good idea since they may assist minimize Capital Gains Tax when you sell your company.

A retirement plan tries to offer financial assistance so that individuals may retire from full-time occupations. A corporate retirement plan is a pension plan that an employer sets up. Some corporate pensions are referred to as “occupation”, “labor”, “corporate”, or “work”.

The first stage in retirement planning is to assess the body required for a stress-free living. Inflation is a major worry since it depreciates the value of money over time, but another long-term problem is that it may not be completely immune from responsibility.

Importance Of Retirement Plans

The retirement plans guarantee improved financial circumstances for retiring workers. Encourage staff retention and recruitment: Severance pay is an essential component of an employee’s overall remuneration. This increases employee participation and pleasure.

It lowers the amount of tax you pay on the yearly income. It enables you to postpone or avoid paying taxes on your investment income. It produces revenue and compound interest impact that standard savings accounts do not have.

The pension has several crucial advantages that might help you build your money quicker. Retirement plans are long-term savings schemes that provide tax breaks. When you get a tax deduction in retirement, part of your money goes to the government instead of into your retirement.

Things To Keep In Mind While Investing In Retirement Plans

With the growing cost of living, healthcare, and life expectancy, retirement planning has become necessary and should be prioritized. Here are a few strategies for selecting the best retirement plans.

1. Ensure That The Inflation Rate is Less Than ROI

Retirement planning may be seen as a long-term financial aim. Many individuals confront the primary difficulty of preserving their investment against capital loss due to shifting inflation rates while investing for the long term.

This inflation might harm the value of your corpus and long-term investments. As a result, it is critical to remember that your return on investment (ROI) should always be greater than the rate of inflation.

2. Always Look For Adequate Retirement Pension

When selecting a retirement plan, remember that you will get sufficient pension income after retirement for you and your family.

Furthermore, you should choose a plan that can give financial security to your loved ones even after your death. Another crucial consideration is that the sum is adequate to cover your costs after different tax deductions.

3. Analyse The Risk And Secure Assured Return

A person may take certain risks to diversify their wealth. However, as you become older and closer to retirement, you should aim to reduce your risk and search for programs that guarantee you solid returns. To combat rising market volatility in the last years before retirement, adhering to assured return on investment and low-risk corpus is essential.

4. Vesting Period

You should always choose a retirement plan with a vesting duration to suit your requirements and demands. There are several pension saving schemes that people may pick for once they reach the age of 40, and people can be secured from an early age, while other plans can even be opted for at the age of 60 if you plan late for retirement.

5. An Appropriate Annuity Alternative

You must choose a retirement plan that includes the best annuity option for you. For example, specific lifelong retirement savings plan alternatives guarantee an annuity for a set number of years regardless of whether the insured person lives. On the other hand, certain retirement plans provide subsidies to the nominees of the guaranteed person after their death.

What Is A Retirement Calculator?

A retirement calculator is a web-based application that assists in calculating the retirement corpus. It is preferable to begin preparing and saving for the retirement finances required to live stress-free after retirement. The retirement calculator can help you figure out how much money you need to keep before retiring.

Personal and financial planning is required for retirement. Personal planning affects retirement contentment, while financial planning assists in budgeting income and spending based on the individual plan.

Personal planning may be accomplished by answering a simple but powerful question. ‘How would you want to spend your retirement time?’

While financial planning can assist predict if one has enough retirement savings to fulfill the kind of retirement they want. Most retirement income would come from government pensions, employment-related sources, or personal assets.

Wrapping It Up

The primary goal of investing in a retirement plan is to provide financial stability and independence when you retire. Before investing in a pension plan, you should examine a few factors that will assist you in selecting the best investment tool/pension scheme. The criteria listed above might help you in making an educated selection.

It is not advised that you keep it if you want to invest and prepare for your retirement. Everyone should take retirement planning seriously since investing in a retirement plan allows people to enjoy a stress-free and financially independent life after retirement. These days, there are several options for a retirement savings plan. As a consequence, making a sound and educated selection is brilliant.

Don’t forget to calculate your retirement corpus with the help of a retirement calculator.

Follow Us: Facebook | Instagram | Twitter |

Entertales is on YouTube; click here to subscribe for the latest videos and updates.